Last month, the non-profit Fashion Revolution released its fifth annual Fashion Transparency Index. The Fashion Transparency Index reviews 250 of the biggest global fashion brands and retailers and ranks them according to how much they disclose about their social and environmental policies, practices, and impacts. This annual report has become a key benchmark in the industry to better understand how major fashion companies are incorporating sustainability, social responsibility, and transparency into their supply chains.

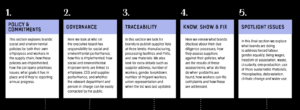

Brands and retailers are assessed in five areas:

- Policy and Commitments: What social and environmental policies the business has in place, what goals they have implemented, and their reported progress

- Governance: How social and environmental responsibility is represented at the board/executive level and how this is implemented

- Traceability: Whether the business has published supplier lists at multiple levels (manufacturing, processing, mills, raw material) and in what degree of detail

- Know, Show & Fix: What information businesses disclose about their due diligence processes and what action is taken when problems are found

- Spotlight Issues: If and how businesses address specific issues such as forced labor, gender equality, deforestation, and living wages

Brands and retailers receive a final score as a percentage, ranging from 0% (zero disclosure) to 100% (complete disclosure and perfect performance in all five areas). The average score in 2020 was 23%.

Here are a few key takeaways from this year’s report.

High street brands are leading the charge to transparency, but the luxury sector is making progress

In 2020, the top ranked brands were all high street fashion retailers:

In 2020, the top ranked brands were all high street fashion retailers:

- H&M – 73%

- C&A – 70%

- Adidas/Reebok – 69%

- Esprit – 64%

- Marks & Spencer and Patagonia – both at 60%

However, luxury brands are not too far behind and have made progress compared to previous years. In 2020, Gucci scored highest among luxury brands with a score of 48%, up from 40% in 2019. Ermenegildo Zelda became the first luxury brand to publish a detailed supplier list, while other brands like Hermès, Balenciaga, Gucci, and Bottega Veneta have also published their own supplier lists (albeit in less detail).

What this means: While luxury brands scored lower than many other brands and retailers, the fact they have taken concrete action to improve their supply chains—in a sector not typically associated with transparency or sustainability—is a promising development. This is evidence that transparency is gaining traction beyond high street brands and points to a growing trend of corporate disclosure in the fashion industry as a whole.

Despite progress, most brands and retailers still lack transparency

Although the fashion industry has made notable progress in recent years, over half (54%) of the brands assessed in 2020 received a score of 20% or less. While this is an improvement from 2019, this means that 135 of the brands and retailers reviewed still have much to do to improve their supply chains. In addition, 15 of these businesses provided little to no information about their supply chain practices or policies, receiving a score of 5% or less.

What this means: The fashion industry is making progress towards more transparent and responsible supply chains, but there still is a long way to go. As of today, brands and retailers can still be profitable despite a lack of transparency. But consumer behavior indicates that this will not last long. More and more shoppers favor clothing that is responsibly made and are choosing to purchase from brands that have clear social and environmental policies in place. Businesses who have not yet implemented initiatives for transparency and responsible sourcing and will be under increasing pressure to do so in the coming years.

There is such thing as too much information

Fashion Revolution found that many brands and retailers, in their efforts to disclose information about their policies, commitments, and progress, repeated the same information or used “filler words and fluff explanations…that obscure what information or data is actually relevant and useful.” In other words, some businesses shared supply chain data for the sake of sharing data, without providing tangible results or drawing meaningful conclusions.

Fashion Revolution found that many brands and retailers, in their efforts to disclose information about their policies, commitments, and progress, repeated the same information or used “filler words and fluff explanations…that obscure what information or data is actually relevant and useful.” In other words, some businesses shared supply chain data for the sake of sharing data, without providing tangible results or drawing meaningful conclusions.

This “data dumping” has a negative impact on both brands and consumers. Brands may appear transparent but fall apart under closer scrutiny, whereas consumers may be misled to believe their favorite businesses are more ethical and transparent than they truly are.

What this means: Several brands have recognized the need for transparency and share supply chain information to demonstrate their achievements and progress. But this information must be easily understood by consumers. Rather than sharing complicated technical data or relying on greenwashing, businesses must analyze, transform, and explain their findings in way that is clear, honest, and easily understood by consumers. In this way, brands and retailers can maintain their credibility and further support their reputation as a transparent business.

The 2020 Fashion Transparency Index shows that the fashion industry as a whole is slowly but surely increasing the visibility of their supply chains and implementing policies focused on social and environmental responsibility. While over half of brands and retailers assessed still have significant room to improve, there is a clear trend towards greater transparency and disclosure.

In the coming years, the next priority for businesses will be ensuring that the information they share about their products and supply chains is purposeful and intentional. Fashion brands and retailers should strive to inform their consumers about the progress they have made, while remaining open and honest about the challenges they still face in their journey to transparency.

Did you like this article? Follow Transparency-One on Twitter and LinkedIn.